Company Highlights 2023

April 2, 2024

Security Mutual Life Insurance Company of New York—The Company That Cares®—is a well-respected life insurance company. The Company provides competitive life insurance products and services, and is known for its financial soundness, quality service, professional life insurance advisors, equitable treatment of policyholders, and dedication to planned personal and business financial security.

Our Mission

Security Mutual Life’s corporate mission is to provide sound and equitable protection for financial needs resulting from death, disability, or retirement. This mission is carried out through manufacturing and distributing life insurance and annuity products; treating with dignity and respect all who put their trust in us.

As a mutual life insurance company, Security Mutual Life is managed for the benefit of its policyholders.

Making a Difference in the Lives We Touch!

Our Mission

Financial Strength Rating

Our financial strength and ability to meet our obligations are recognized by the A.M. Best Company.

A.M. Best

A-

(Excellent)1

Experience

With 137 years of experience, Security Mutual Life has been helping protect families and businesses during periods of prosperity, as well as during wars and times of economic uncertainty. Additionally, in 2023 the Company paid policy dividends to participating policyholders,2 as we have done every year since 1893.

The Company’s strong performance represents the cumulative effect of many steps taken over time. We continue to work to effectively position the Company to prosper and grow today and in the future.

Policyholder Value

In our strategic plans and corporate operations, we focus on the Company’s financial strength and asset quality to provide long-term policyholder value.

Asset Quality

Security Mutual Life maintains a conservative investment philosophy. The investments of the Company consist predominantly of high-quality, fixed-maturity, investment-grade securities.

In addition to our bond portfolio, we also have a commercial mortgage portfolio of $274.4 million secured by high-quality real estate and representing 9.22 percent of the Company’s total invested assets as of December 31, 2023. We continue to maintain stringent commercial mortgage underwriting guidelines and monitoring procedures, which has resulted in a favorable long-term credit experience.

The investment operations are monitored and approved by Security Mutual Life’s Board of Directors.

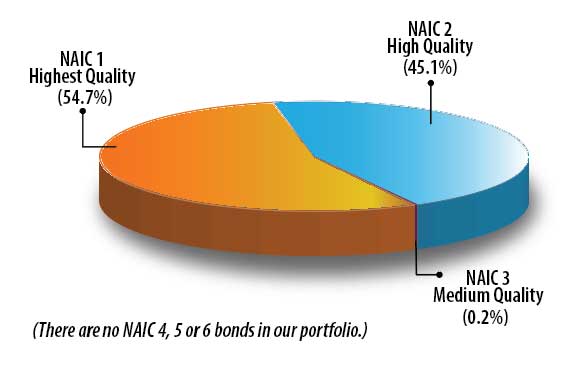

2023 Bond Portfolio Quality3

Total Bonds as of 12/31/23 (000s): $1,943,330

99.8% Investment Grade

Total Invested Assets

| Summary: $2,975,990 | As of 12/31/23 (000s)

|

|

| Cash & Short Term | $ 38,108 |

1.28% |

| Bonds | 1,943,330

|

65.30%

|

| Mortgages | 274,398 |

9.22% |

| Policy Loans | 633,945 |

21.30% |

| Stocks (non-public) | 4,710 |

0.16% |

| Real Estate | 11,122 |

0.37% |

| Other | 70,377 |

2.37% |

| Totals | $2,975,990 |

100.00% |

Non-investment grade assets as a percentage of invested assets were 0.10 percent, well below reported industry averages.

1The A.M. Best rating is current as of the date of publication. Ratings reflect a rating agency’s opinion of a company’s financial strength and ability to meet its obligations to policyholders. A rating is not a recommendation of a company or any specific policy form. A.M. Best’s “A-” (Excellent) rating is the fourth highest on a 16-step rating scale. Ratings are subject to change. For further information about Security Mutual’s Life’s ratings, please click here.

2The payment of dividends is not guaranteed, and the amount credited, if any, may rise and fall depending on experience factors such as investment income, taxes, mortality and expenses.

3The National Association of Insurance Commissioners (NAIC) employs a bond-rating system ranging from 1 – 6, with NAIC Classification 1 defined as Highest Quality, NAIC Classification 2 defined as High Quality, and NAIC Classification 3 defined as Medium Quality. Classifications 4 – 6 range from Low Quality to In or Near Default.