Articles

What You Need to Know About the SECURE Act and Your Retirement Savings

Episode 53 – The SECURE Act is now law. It significantly impacts how we save in our IRAs and retirement accounts, and how we spend those savings. Here’s a brief summary of some of the more important provisions. Contact your local Security Mutual life insurance advisor today to review how the SECURE Act impacts your financial and retirement goals and objectives. Continue Reading What You Need to Know About the SECURE Act and Your Retirement Savings

If You’re a Closely Held Business Owner—Why You Need an SML Life Insurance Advisor

Closely held business owners have many common concerns such as business succession, employee retention, government regulations, taxes and health insurance. Learn how your Security Mutual Life Insurance Advisor can help you achieve financial security.

Is Employee Retention a Problem for You?

As a business owner, is retaining your top employees a concern for you, particularly as it relates to your best salespeople, company managers and executives? If so, you’re not alone. Whether your business is small, medium or large, attracting and retaining top talent...

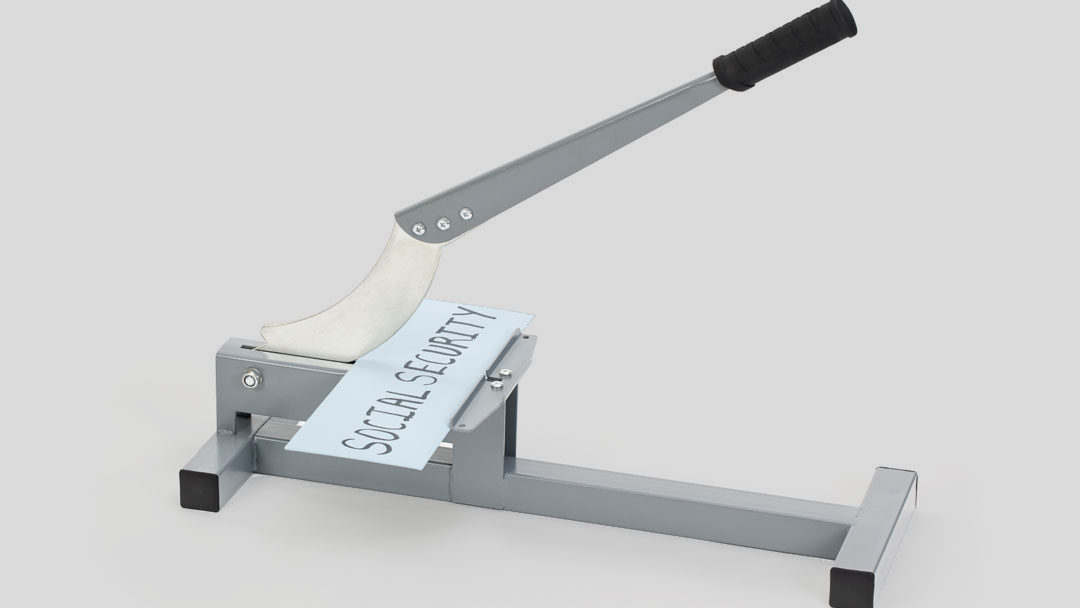

Social Security Survivor Benefits

Episode 49 - Learn more about Social Security Survivor Benefits in this podcast episode of SML Planning Minute. Continue Reading Social Security Survivor Benefits

Why Conduct a Life Insurance Review?

Episode 23 – Despite the amount of life insurance in your estate, it is an asset that is generally not evaluated, reviewed, or appraised on a consistent and comprehensive basis. Continue Reading Why Conduct a Life Insurance Review?

Add Some Certainty to Your Financial Plan!

With Security Mutual Life’s Security Designer WL4U® whole life insurance products, you can leave a legacy in the form of a death benefit to your heirs, plus participating whole life guarantees can add an element of certainty to your financial plan.

Looking for a Tax Deduction?

Is it better to purchase a depreciating asset or one that appreciates in value? Either way, we have an answer. Using the Section 179 Deduction is a good option if you need a vehicle or equipment. An employer-sponsored retirement plan is a good alternative if you’re...

Social Security and the Government Shutdown

The partial government shutdown drags on and on. Some government employees have been furloughed, and certain government services are currently unavailable. Not so for Social Security. The shutdown has had no impact on Social Security or disability checks. “There is no...

Social Security and Government Employees: Part Two – Windfall Elimination Provision

In Part One of this series of articles, we looked at certain types of government employees. These are people who have worked previously with a “non-covered” pension. That is, they worked at a job where they didn’t have to pay Social Security (SS) withholding taxes...

Social Security and Government Employees: Part Three – Government Pension Offset

In Parts One and Two of this series, we looked at certain types of government employees who have worked previously with a “non-covered” pension. That is, they worked at a job where they didn’t have to pay Social Security withholding taxes, but got a separate pension...

Reach Us

Sed ut perspiciatis unde omnis iste natus voluptatem.

13005 Greenville Avenue,

California, TX 70240

+22 140 006 754