Articles

Looking for a Tax Deduction?

Is it better to purchase a depreciating asset or one that appreciates in value? Either way, we have an answer. Using the Section 179 Deduction is a good option if you need a vehicle or equipment. An employer-sponsored retirement plan is a good alternative if you’re...

Social Security and the Government Shutdown

The partial government shutdown drags on and on. Some government employees have been furloughed, and certain government services are currently unavailable. Not so for Social Security. The shutdown has had no impact on Social Security or disability checks. “There is no...

Social Security and Government Employees: Part Two – Windfall Elimination Provision

In Part One of this series of articles, we looked at certain types of government employees. These are people who have worked previously with a “non-covered” pension. That is, they worked at a job where they didn’t have to pay Social Security (SS) withholding taxes...

Social Security and Government Employees: Part Three – Government Pension Offset

In Parts One and Two of this series, we looked at certain types of government employees who have worked previously with a “non-covered” pension. That is, they worked at a job where they didn’t have to pay Social Security withholding taxes, but got a separate pension...

Social Security and Government Employees: Part One – The Basics

Government employees are a seriously under served market, particularly when it comes to Social Security. And there’s one interesting reason: Very few people truly understand how Social Security integrates with “non-covered” pensions. That is, pensions, often for state...

Divorce and Remarriage

What happens to Social Security after divorce occurs? Here's a quick summary. First, a divorced spouse who was married for at least ten years is entitled to the same Social Security spousal benefit as a married spouse. That is, he or she may receive up to 50 percent...

How Do You Define Success?

Is it revenue, income or innovation? Perhaps your ability to give back to your community? Maybe improved well-being of your employees and increased ability to provide for your own family? Maybe you’re just starting out and want it all. Whatever your financial goals,...

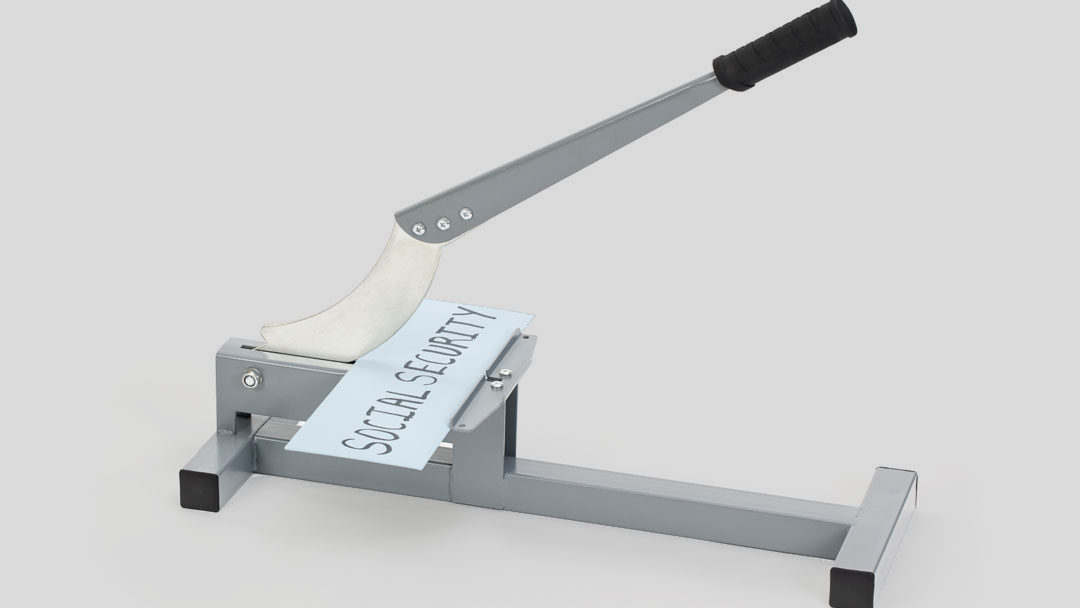

Will it Still Be There?

There is some disturbing language—in bold print, no less—on the second page of any individual Social Security statement issued by the SSA: Your estimated benefits are based on current law. Congress has made changes to the law in the past and can do so at any time. The...

An In-Depth Case Study on Social Security Taxation

When you take a serious look at the nuts and bolts of Social Security taxation, the results are staggering. And so is the amount of money you can save if you plan properly. And by planning properly, we mean that you can save a great deal of money in taxes...

Social Security—A Single Life Only Benefit

You look into the future. You picture yourselves as a couple who has worked together, accumulated your assets together, and combined your incomes to create your lifestyle for your “golden years.” It’s been a productive life and you live within your means. It appears...

Reach Us

Sed ut perspiciatis unde omnis iste natus voluptatem.

13005 Greenville Avenue,

California, TX 70240

+22 140 006 754